How to link PAN card with Aadhaar online

The Supreme Court has said consumers' Aadhaar ID will have to be listed with tax returns starting July, saying this move will help curb tax evasion. If you are planning to link your Aadhaar number with PAN card, or have received an email from UIDAI regarding the same, but are not sure how to do so, we are here to help. The easiest way to do this is via an e-facility launched by the Income Tax department that makes the process very convenient for one and all. The option to add your Aadhaar number with the income tax form alongside the PAN has been around for a couple of year, but now you don't even need to sign in to the IT website to link your Aadhaar number and PAN card.

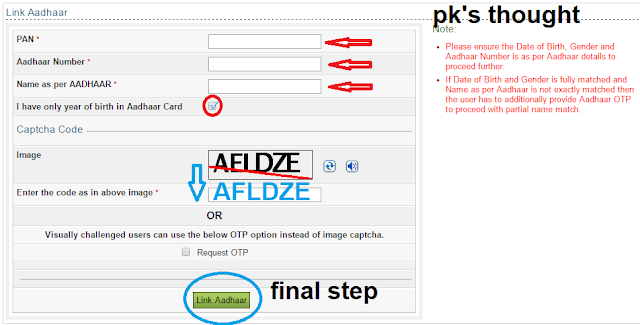

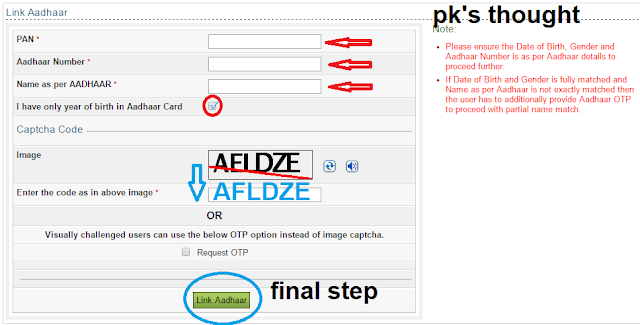

If you want to link your Aadhaar with PAN card, head over to the Income Tax e-filing portal and follow the steps below:

1.On the website (https://incometaxindiaefiling.gov.in/), click on the link on the left saying Link Aadhaar.

2.Now, enter your PAN number, Aadhaar number, name as per Aadhaar, and the Captcha, and then click on Link Aadhaar.

3.This should link the PAN and Aadhaar, but if there is any discrepancy in your details, you'll receive an Aadhaar OTP to confirm the linkage. Enter the OTP and click on Save to continue.

4.You can also link the details after logging in to the income tax website. Log in as you normally would and then click on Profile Settings in the top menu.

5.Next, find Link Aadhaar.

6.Enter your Aadhaar number and click on Save to continue.

This will only work if the details on the PAN and the Aadhaar card match. In case of any discrepancies, you can upload a scan of your PAN card, or register via OTP on your linked mobile number as mentioned above.

SMS format to link Aadhaar with PAN

Send SMS to 567678 or 56161 in following format:

UIDPAN<12 digit Aadhaar><10 digit PAN>

Example: UIDPAN 3421342112341784 AAAeAE12EE

The department issued ads in newspapers across the country and explained how both the both the unique identity numbers of a person can be attached by sending a message to either 56161 or 567678.

People can also go to the official e-filing website of the Income Tax Department and link both these documents. Linking these two proofs of identity will help you to get tax facilities online.

The Supreme Court has said consumers' Aadhaar ID will have to be listed with tax returns starting July, saying this move will help curb tax evasion. If you are planning to link your Aadhaar number with PAN card, or have received an email from UIDAI regarding the same, but are not sure how to do so, we are here to help. The easiest way to do this is via an e-facility launched by the Income Tax department that makes the process very convenient for one and all. The option to add your Aadhaar number with the income tax form alongside the PAN has been around for a couple of year, but now you don't even need to sign in to the IT website to link your Aadhaar number and PAN card.

If you want to link your Aadhaar with PAN card, head over to the Income Tax e-filing portal and follow the steps below:

1.On the website (https://incometaxindiaefiling.gov.in/), click on the link on the left saying Link Aadhaar.

2.Now, enter your PAN number, Aadhaar number, name as per Aadhaar, and the Captcha, and then click on Link Aadhaar.

3.This should link the PAN and Aadhaar, but if there is any discrepancy in your details, you'll receive an Aadhaar OTP to confirm the linkage. Enter the OTP and click on Save to continue.

4.You can also link the details after logging in to the income tax website. Log in as you normally would and then click on Profile Settings in the top menu.

5.Next, find Link Aadhaar.

6.Enter your Aadhaar number and click on Save to continue.

This will only work if the details on the PAN and the Aadhaar card match. In case of any discrepancies, you can upload a scan of your PAN card, or register via OTP on your linked mobile number as mentioned above.

SMS format to link Aadhaar with PAN

Send SMS to 567678 or 56161 in following format:

UIDPAN<12 digit Aadhaar><10 digit PAN>

Example: UIDPAN 3421342112341784 AAAeAE12EE

The department issued ads in newspapers across the country and explained how both the both the unique identity numbers of a person can be attached by sending a message to either 56161 or 567678.

People can also go to the official e-filing website of the Income Tax Department and link both these documents. Linking these two proofs of identity will help you to get tax facilities online.

No comments:

Post a Comment